Simplify all your banking and loan methods.

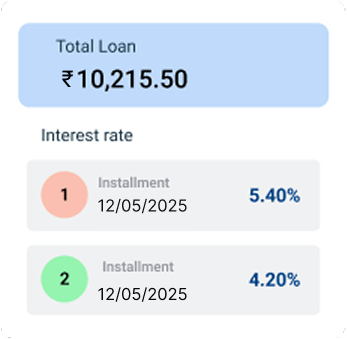

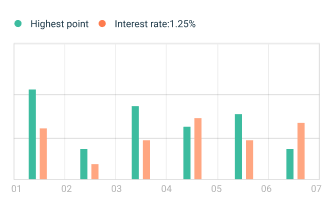

- Get Best Interest Rates

- Quick approvals

Pan India customer base from over 120 cities

Almost over 250 thousand active users

25+ years worth of experience as a industry expert

We have better and more feature

Fast Mobility

Speedy services designed for convenience.

Term Loan

Flexible repayment options at low interest.

Easy Experience

User-friendly process with guided steps.

Safe and protected

Your data and transactions are secure.

Wordwide

Services accessible from anywhere globally.

No hidden charges

Simple, transparent pricing—no hidden costs.

Merchant Payment

Quick and easy payments to multiple vendors.

24/7 Support

Get help any time through chat or call.

3 steps to follow

Our streamlined loan process ensures quick approval and disbursement. We've simplified the traditional banking experience to make it faster, more transparent, and completely digital.

Apply for loan

Fill out our simple online form with basic details. Quick and easy process to get started.

Get approved

24-hour review process with expert verification. Get personalized loan offers with competitive rates.

Money in account

Direct bank transfer within 48 hours. Track status in real-time and use funds immediately.

Calculate and confirm your loans

Loan Calculator

- EMI Amount (Principal + Interest)

- Interest Payable

- Loan Duration

- Your EMI Amount

We offer a wide variety of financial products

Personal Loans

Quick and easy personal loans for your immediate needs with flexible repayment options and competitive interest rates.

Business Loans

Comprehensive business financing solutions to help your company grow, expand operations, or manage working capital.

Home Loans

Affordable home financing with attractive interest rates, flexible tenures, and minimal documentation requirements.

Loan Against Property

Unlock the value of your property with secured loans offering higher loan amounts and lower interest rates.

Car Loans

Drive your dream car with our hassle-free auto loans featuring quick approval and competitive interest rates.

Term Insurance

Secure your family's future with affordable term insurance plans offering comprehensive coverage and flexible terms.

Health Insurance

Comprehensive health coverage plans to protect you and your family against medical emergencies and hospitalization.

Life Insurance

Ensure financial security for your loved ones with our range of life insurance products tailored to your needs.

Learn about how Finsworth works

1.5M Active Customers

30k Business Partners

What Our Customers Are Saying

"Finsworth made my home loan process incredibly smooth. Their team was always available to answer my questions, and I got the best interest rate in the market. The online application process was straightforward and hassle-free."

Gaurav

"As a business owner, I needed quick financing to expand my operations. Finsworth's business loan process was efficient and transparent. Their competitive rates and flexible repayment options helped me grow my business successfully."

Vijay Kumar Mehta

"I was impressed by Finsworth's car loan service. The approval was quick, and the documentation process was minimal. Their customer service team guided me through every step, making my car purchase experience stress-free."

Divit Ahuja

"Finsworth's health insurance plan provided comprehensive coverage for my family. Their claim settlement process was quick and hassle-free. The premium rates are reasonable, and the coverage is extensive. Highly recommended!"

Mahipal Godara

What Our Customers

Are Saying

Gaurav

Vijay Kumar Mehta

Divit Ahuja

Mahipal Godara

Frequently asked general questions

What documents do I need to apply for a loan?

You'll need to provide identity proof (Aadhaar Card, PAN Card), address proof (Aadhaar Card, Passport, Utility Bills), income proof (Salary Slips, Bank Statements), and property documents (for secured loans). The exact requirements may vary based on the loan type and amount.

How long does the loan approval process take?

Our loan approval process typically takes 2-3 working days for personal loans and 5-7 working days for home loans, subject to complete documentation and verification. We strive to process applications as quickly as possible while ensuring thorough due diligence.

Can I prepay my loan? Are there any charges?

Yes, you can prepay your loan. For floating rate loans, there are no prepayment charges. For fixed rate loans, a nominal prepayment charge may apply after the lock-in period. We recommend checking the specific terms of your loan agreement for detailed information.

What factors affect my loan interest rate?

Your loan interest rate is determined by several factors including your credit score, income, employment stability, loan amount, tenure, and the type of loan. A higher credit score and stable income typically result in better interest rates. We offer competitive rates based on your profile and market conditions.

How can I track my loan application status?

You can track your loan application status through our website or mobile app using your application reference number. Additionally, our dedicated relationship manager will keep you updated on the progress of your application through SMS and email notifications.

Have more questions? Contact Us

Get your own personal consultation

Connect with our expert financial consultants who will guide you through the best loan options tailored to your needs. We offer personalized solutions with competitive rates and flexible terms.

+91-8890554432

OFFICE NO 205 A AND B, 2ND FLOOR , ADITYA ARCADE COMPLEX , PREET VIHAR, DELHI - 110092 NEAR - DOMINO'S AND BIKANER SWEETS

Get in touch

Privacy Policy

1. Information We Collect

We collect information that you provide directly to us, including:

- Personal identification information (Name, email address, phone number)

- Financial information (for loan applications and processing)

- Documentation required for loan processing

- Communication preferences

2. How We Use Your Information

We use the collected information for:

- Processing your loan applications

- Providing customer support

- Sending important updates about your loan

- Improving our services

- Complying with legal obligations

3. Information Sharing

We may share your information with:

- Financial institutions and lenders

- Credit reporting agencies

- Service providers and business partners

- Legal authorities when required by law

4. Data Security

We implement appropriate security measures to protect your personal information, including:

- Encryption of sensitive data

- Secure data storage systems

- Regular security assessments

- Access controls and authentication

5. Your Rights

You have the right to:

- Access your personal information

- Correct inaccurate data

- Request deletion of your data

- Opt-out of marketing communications

6. Contact Us

For any privacy-related questions or concerns, please contact us at:

Email: privacy@finsworth.com

Phone: +91 98765 43210

Terms of Use

1. Acceptance of Terms

By accessing and using Finsworth's services, you agree to be bound by these Terms of Use and all applicable laws and regulations.

2. Services Description

Finsworth provides:

- Loan processing and management services

- Financial advisory services

- Online account management

- Customer support services

3. User Responsibilities

Users must:

- Provide accurate and complete information

- Maintain the security of their account

- Comply with all applicable laws

- Use the services for lawful purposes only

4. Loan Terms

All loans are subject to:

- Approval based on credit assessment

- Applicable interest rates and fees

- Repayment terms and conditions

- Security and collateral requirements

5. Intellectual Property

All content and materials on this website are protected by intellectual property rights and may not be used without permission.

6. Limitation of Liability

Finsworth is not liable for:

- Indirect or consequential damages

- Loss of data or business interruption

- Third-party actions or content

7. Changes to Terms

We reserve the right to modify these terms at any time. Users will be notified of significant changes.

8. Contact Information

For questions about these terms, please contact:

Email: legal@finsworth.com

Phone: +91 98765 43210